The Growth Equity fund for

European

B2B

Technology

Companies

Move Capital Fund I is a pan-European Growth Equity fund focused on highly strategic sectors around the Data value chain and aims to nurture European Tech champions. We make investments in cutting-edge fields such as IoT, AI, Cyber Security, Data Analytics, Machine Learning, Industry 4.0, etc. Move Capital Fund I ("Move Capital") is part of the Kepler Cheuvreux Invest management company.

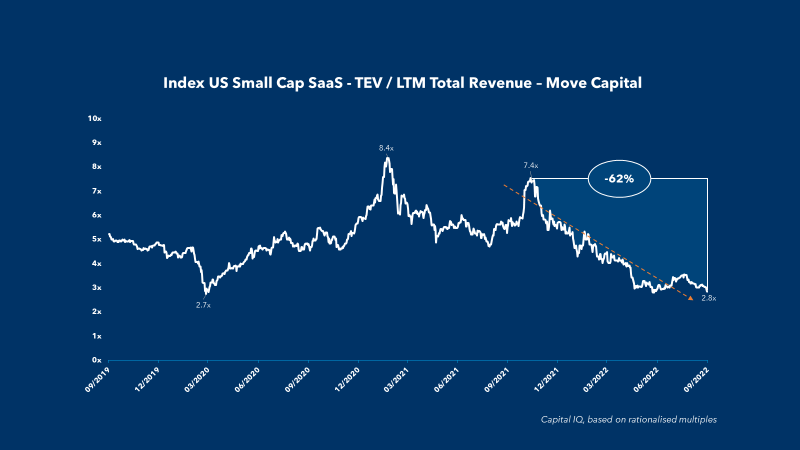

We believe there is a liquidity gap in tech B2B growth-stage companies in France and Europe.

Such promising companies need to be financed by Tech specialists with an unparalleled experience in helping companies to expand

We focus on strategic sectors within the data value chain

We support B2B tech companies with proven business models

We are Tech expert

Pan-European pluridisciplinary team with strong investment track record

We actively contribute to the portfolio companies’ growth

Through our hands-on approach and industrial and operational expertise

We are high-conviction investors with strong ESG priorities

We actively promote a sustainable ecosystem

We are entrepreneurs

We speak the same language as entrepreneurs and share the same values

We exclusively focus on highly strategic sectors within the data value chain

We support B2B Tech companies with proven business model and strong scale-up potentials.

We are Tech expert

Pan-European Pluri-disciplinary team with strong investment track record.

We actively contribute to the portfolio companies’ growth

Through our hands-on approach and industrial and operational expertise.

We are high-conviction investors with strong ESG priorities

We actively promote a sustainable European Technology ecosystem with a rigorous ESG approach