Hervé Malaussena, Founding Partner of Move Capital, was interviewed by L'Agefi, France's premier finance publication, concerning the recent reduction in valuation for B2B Tech businesses.

Snapshot:

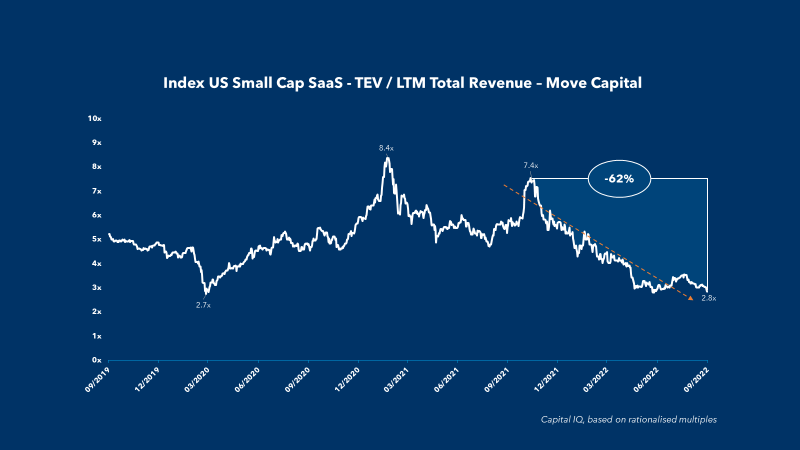

Europe has been heavily struck by a now worldwide phenomena a few months later than the US: investors are increasingly hesitant to overpay for their exposure to technology equities. Following the capital markets, the late stage venture capital (growth capital) segment is already being impacted, as evidenced by the 85% devaluation of the Swedish fractional payment expert Klarna between its last two fund-raising rounds.

On the surface, this turnaround appears to be unsurprising. The many uncertainties that loom over the global economy have caused a re-evaluation of predictions and risk premiums, while rising interest rates have an impact on the discounting of cash flows expected by sector participants. Far from previous excesses, analytical grids are once again converging towards these companies' fundamentals, speeding a beneficial restructuring of valuations.

Read more: Agefi & attached PDF

On the surface, this turnaround appears to be unsurprising. The many uncertainties that loom over the global economy have caused a re-evaluation of predictions and risk premiums, while rising interest rates have an impact on the discounting of cash flows expected by sector participants. Far from previous excesses, analytical grids are once again converging towards these companies' fundamentals, speeding a beneficial restructuring of valuations.

Read more: Agefi & attached PDF